Form Preparation

Effortless Form Preparation Let Us Handle the Details

Precision For a Smooth Tax Preparation

What are tax preparation forms?

Tax preparation forms are official documents used to report income, deductions, and other relevant financial aspects to tax authorities. They are crucial for fulfilling tax obligations and avoiding penalties.

Empower your financial future

We’re more than just a firm — we’re your trusted partner in building a stronger financial future.

From taxes and accounting to insurance, our experienced team offers personalized support to help you move forward with clarity and confidence.

PAGIO's Services

● Tax Services

● Accounting

● Insurance

● Corporate Services

What are some common examples of tax preparation forms?

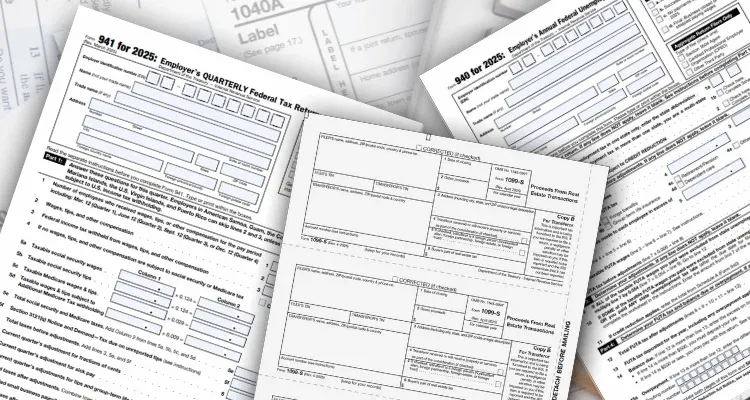

Some common forms include 1099, W-2s, Form 940, and Form 941. Each serves a specific purpose and is used to report different types of income, withholdings, and tax obligations.

What information is provided on these forms?

These forms typically include details about income received, taxes withheld, tax benefits, and other information relevant for tax calculation and regulatory compliance.

Get Your Forms Completed Accurately the First Time

Forms are a necessary part of doing business and managing personal finances, but they can also be a source of frustration. Whether you need help with tax forms, business filings, or other official documents, accuracy is essential. A single error can delay processing, trigger rejections, or create compliance issues that take time and money to resolve.

Small Errors Lead to Big Delays

Government agencies and financial institutions have little tolerance for mistakes. An incorrect Social Security number, a missing signature, or a miscalculated figure can send your paperwork back to square one. For businesses, this can mean delayed permits, rejected applications, or compliance penalties. For individuals, it often results in held refunds or denied benefits.

Many people underestimate how much time and attention proper form preparation requires. It's not just about filling in the blanks. It's about understanding what each field requires and making sure every piece of information is accurate and complete before submission.

Professional Form Preparation You Can Trust

At PAGIO's, we offer document preparation services that ensure your forms are completed correctly and submitted on time. We work with individuals and businesses to handle a wide range of paperwork, including:

- Federal and state tax forms

- Business license and permit applications

- Employer tax filings and year-end forms

- Contractor and vendor documentation

- Personal financial forms and applications

Not Sure Which Forms You Need?

Figuring out the right forms for your situation can be confusing, especially when requirements vary by state or change over time. We help you identify exactly what's needed and ensure nothing is missed. Whether it's a one-time filing or ongoing documentation, we take the guesswork out of the process.

You don't have to spend hours researching instructions or worrying about whether you checked the right boxes. Our team handles the details so you can move forward with confidence.

Attention to Detail That Makes a Difference

We've prepared thousands of forms for clients in a variety of situations. That experience means we know where mistakes commonly happen and how to avoid them. Every form we prepare is reviewed for accuracy before it leaves our hands, giving you one less thing to worry about.

Paperwork Shouldn't Slow You Down

If forms and filings have been sitting on your to-do list for too long, it might be time to hand them off to someone who can get them done right. Reach out to PAGIO's

and let's get your paperwork in order.

Get It Filed Right, The First Time

Accurate Forms for Every Requirement

Whether it’s 1099s, W-2s, 940 or 941 our team ensures all your forms are prepared correctly, on time, and in full compliance.